So after polling half the population of California last night about loans, we've decided to go with an Interest Only loan.

Judging by the audible gasp that I just heard you make, you might think thats a crazy idea. Well, I did at first too. In fact, I've been running around for the past 2 years telling people what a crazy idea it is.

What made me change my mind? Well, I finally sat down and actually calculated the difference between an interest only (hereafter i/o) loan and a regular amortized loan. The difference? Not much in the short term (less than 5 years).

You probably already know this, but because of the way home loans are structured, for your first few years that you're paying it off on a regular amortized loan you're paying almost all interest anyway. The bank structures the payments so they get their money (the interest you pay) first, then you get your money (the principle, the equity in the home) later in the loan.

Hey, why run a bank if you don't get to do money tricks like that, eh?

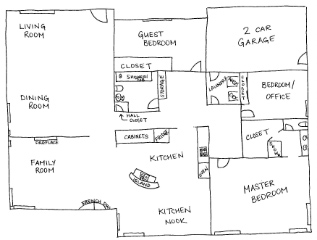

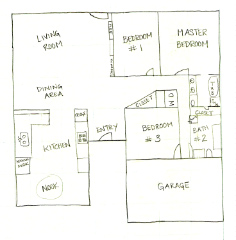

So when I calculated it out for the length of time that we're planning to stay in the house we buy (less than 5 years) there isn't much difference in the amount of equity that we would have between the i/o and amortized loan.

As another bonus point for i/o loans, because you don't have to pay down the principle, the payments will be much lower, thus we can buy more house.

And the amount of house that we can afford with an i/o loan is just about the level of house that we've been wanting.